There are numerous choices available when it comes to auto insurance. Progressive and Nationwide are two of the most famous brands in the sector. While both businesses provide auto insurance as well as other insurance-related goods, there are some significant distinctions between them. Let’s find out if “Are Progressive and nationwide the same?” be with Carism.info.

Are Progressive and Nationwide the same?

The History of Each Company

As Progressive Mutual Insurance Company, Progressive was established in 1937 by Joseph Lewis and Jack Green. The business was established to offer drivers who might not be able to get coverage from other suppliers affordable auto insurance. Progressive offers a variety of insurance products, including auto, home, and life insurance, and is currently one of the biggest car insurance companies in the US.

On the other hand, Nationwide began as the Farm Bureau Mutual Automobile Insurance Company and was established in 1925. The business was established to offer farms in Ohio auto insurance. As a Fortune 100 company today, Nationwide provides a range of insurance and financial products, including life, home, and auto insurance.

Pros and Cons

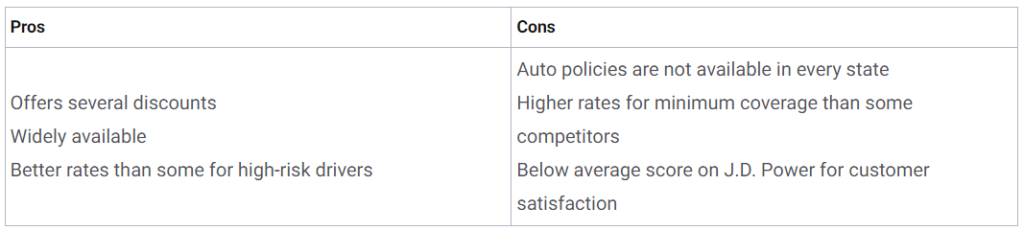

Nationwide:

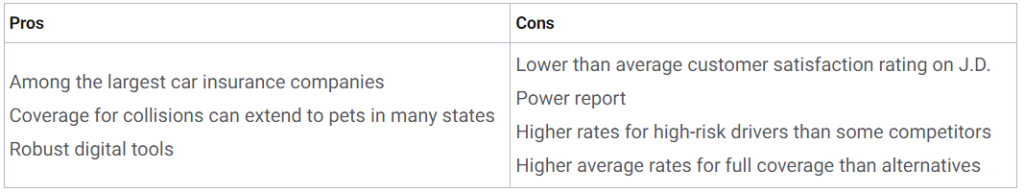

Progressive:

Nationwide cheaper than Progressive?

Progressive auto insurance is more expensive than Nationwide auto insurance. Progressive car insurance costs $317 monthly on average, compared to Nationwide’s $242 monthly average.

The cost per month varies, though. Auto insurance rates are influenced by a number of individual variables, including age, gender, driving records, and even credit score.

See how each element affects the rates for Nationwide insurance and Progressive insurance by reading the sections below.

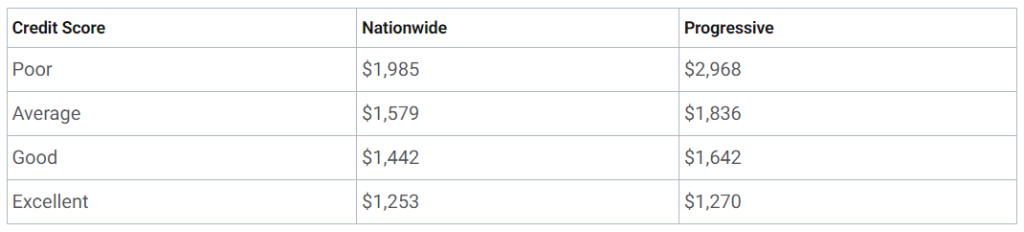

Nationwide is less expensive for drivers with bad credit

In California, Hawaii, Massachusetts, and Michigan, auto insurance firms are not allowed to use your credit score in determining how much you will pay for coverage. Since low credit scores have been associated with a greater propensity to file claims, other states may use your credit scores to determine your rates.

However, not all lenders consider credit, nor do they consider it equitably. Comparing quotes from the providers you are contemplating may be helpful to identify which might provide more competitive rates for your credit situation. You can get an idea of what Nationwide and Progressive charge for various credit levels by looking at the averages below:

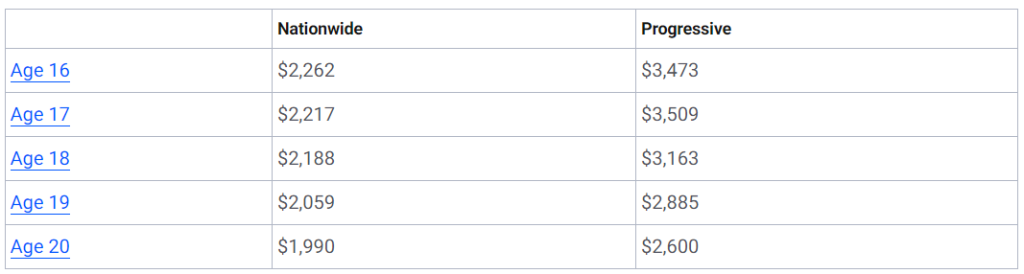

Nationwide is less expensive for young drivers

Another element that might affect your auto insurance cost is age. Due to their inexperience and higher accident risk, younger drivers usually pay the highest rates. Nationwide is probably going to be the least expensive choice for inexperienced drivers overall. The table below compares the typical annual premiums from Nationwide and Progressive according to age.

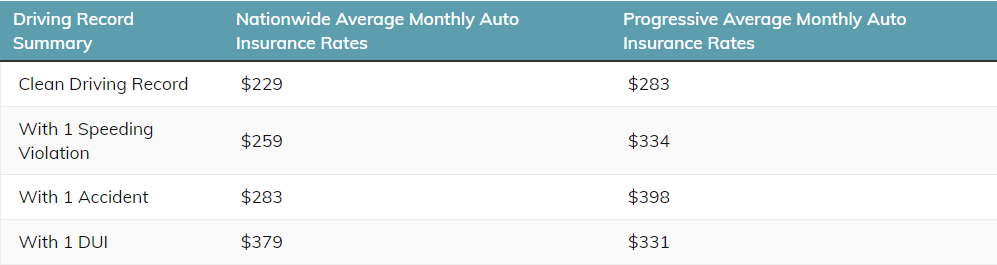

Nationwide is cheaper by driving record

Depending on your driving history, Nationwide car insurance is less costly than Progressive car insurance, but some infractions may increase that cost.

Compare the two businesses’ auto insurance rates according to driving records to see which is less expensive.

Progressive insurance is more reasonable for drivers with DUI convictions, even though Nationwide insurance is generally less expensive.

Keeping a spotless driving record is the best method to get cheap auto insurance. A speeding citation has little impact, but multiple violations can result in hundreds of dollars’ worth of rate increases.

Discounts: Are Progressive and Nationwide the same?

Both Nationwide and Progressive provide an impressive collection of auto insurance discounts. However, there are various ways to save with each service. The following are a few distinctive and noteworthy auto insurance discounts that might be offered by each provider:

Nationwide discounts

- SmartRide. When you join up for Nationwide’s usage-based insurance program SmartRide, you might be eligible for an immediate 10% discount. The savings you could receive could be as high as 40%, and they would increase the safer you drive.

- Discount for safe drivers. If you have not had any accidents or serious violations on your record for at least five years, you might be eligible for the cautious driver discount.

- Multiple-policy discount. You could save up to 20% when you combine a home and auto insurance with Nationwide. Progressive’s multi-policy discount, on the other hand, offers average savings of 4%, which might translate into lesser savings for policyholders.

Progressive discounts

- Discount for teen drivers. After adding a freshly licensed driver to your insurance, the teen driver discount offered by Progressive might help prevent your rate from rising noticeably.

- Discount for complete payment. If you pay your annual premium immediately and in full rather than in monthly instalments, Progressive might give you a discount.

- Deductible savings bank. With Progressive’s premium Savings Bank, you might be able to reduce your collision or comprehensive insurance premium by $50 for each period of time during which you have no claims.

- Online quotation and signature. You may be qualified for a combined discount of up to 16 percent if you obtain your Progressive quote and submit your paperwork online.

Customer Experience Comparison: Are Progressive and Nationwide the same?

Both Progressive and Nationwide have received high marks for customer satisfaction from industry organizations. However, there are some differences in how the two companies are perceived by customers.

Progressive has an above-average score of 818 out of 1,000 in the 2020 J.D. Power U.S. Auto Insurance Study for total customer satisfaction. With a rating of 811 out of 1,000, Nationwide also performs better than normal.

Customers’ perceptions of the two businesses in particular areas do vary somewhat, though. Progressive, for instance, places better than Nationwide in the categories of claims processing and insurance offerings, while Nationwide places better in the category of price.

The Bottom Line

Both insurers offer a variety of drivers car policies with various levels of coverage. Premiums from Nationwide are frequently less costly. Progressive still provides a variety of deals, which could drive down its already low prices.

The greatest deals can always be found by shopping around, but keep in mind that price is only one of many things to take into account. Before committing to a new auto insurance policy or renewing your current coverage, regardless of the provider you pick, make sure you comprehend the specifics of what is protected and know what is best for your circumstances.